In today’s digital era, identity theft and data breaches happen more often than ever. That’s why choosing the right credit monitoring service is essential—not only to protect your financial information but also to stay informed about changes that affect your credit score.

This list of credit monitoring services will help you compare top providers, understand their features, and choose the best one for your needs.

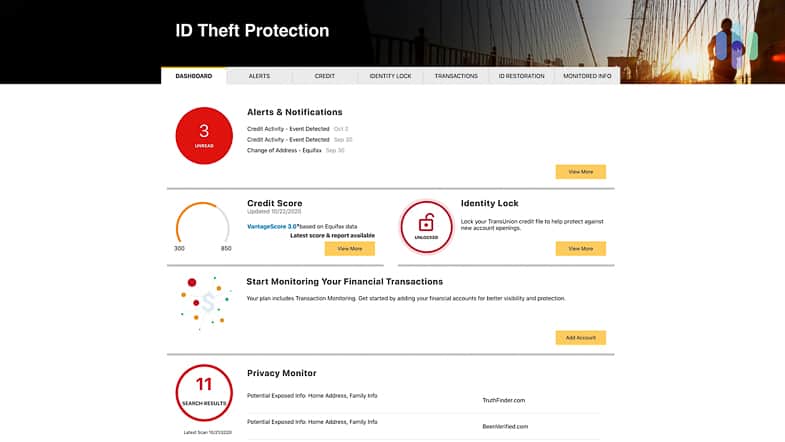

1. LifeLock by Norton

Key Features

-

Real-time credit alerts

-

Identity theft protection and dark web monitoring

-

Up to $1 million identity theft insurance

-

24/7 customer support

Why It’s a Top Choice

LifeLock is one of the most recognized names in identity protection. It offers comprehensive monitoring tools and insurance, making it ideal for individuals who want full financial and digital security coverage.

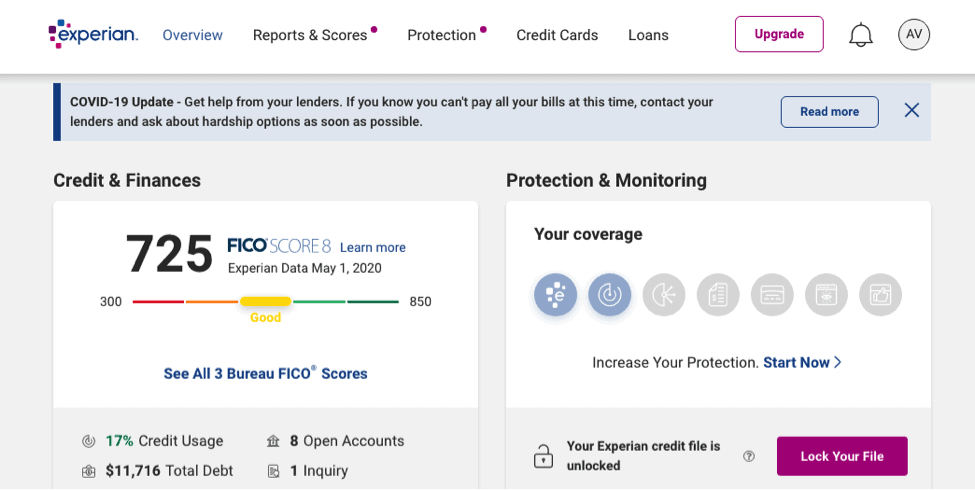

2. Experian CreditWorks

Key Features

-

FICO® Score tracking

-

Daily credit report updates

-

Identity theft alerts

-

Experian Boost integration

Why It’s Popular

Experian CreditWorks is perfect for users who want direct access to Experian’s credit data. With frequent updates and helpful credit improvement tools, it’s one of the most user-friendly monitoring platforms.

3. IdentityGuard

Key Features

-

AI-powered monitoring using IBM Watson

-

3-bureau credit monitoring

-

Risk assessment reports

-

Data breach alerts

Best For

IdentityGuard is ideal for tech-savvy individuals who want powerful, AI-enhanced identity protection at an affordable price.

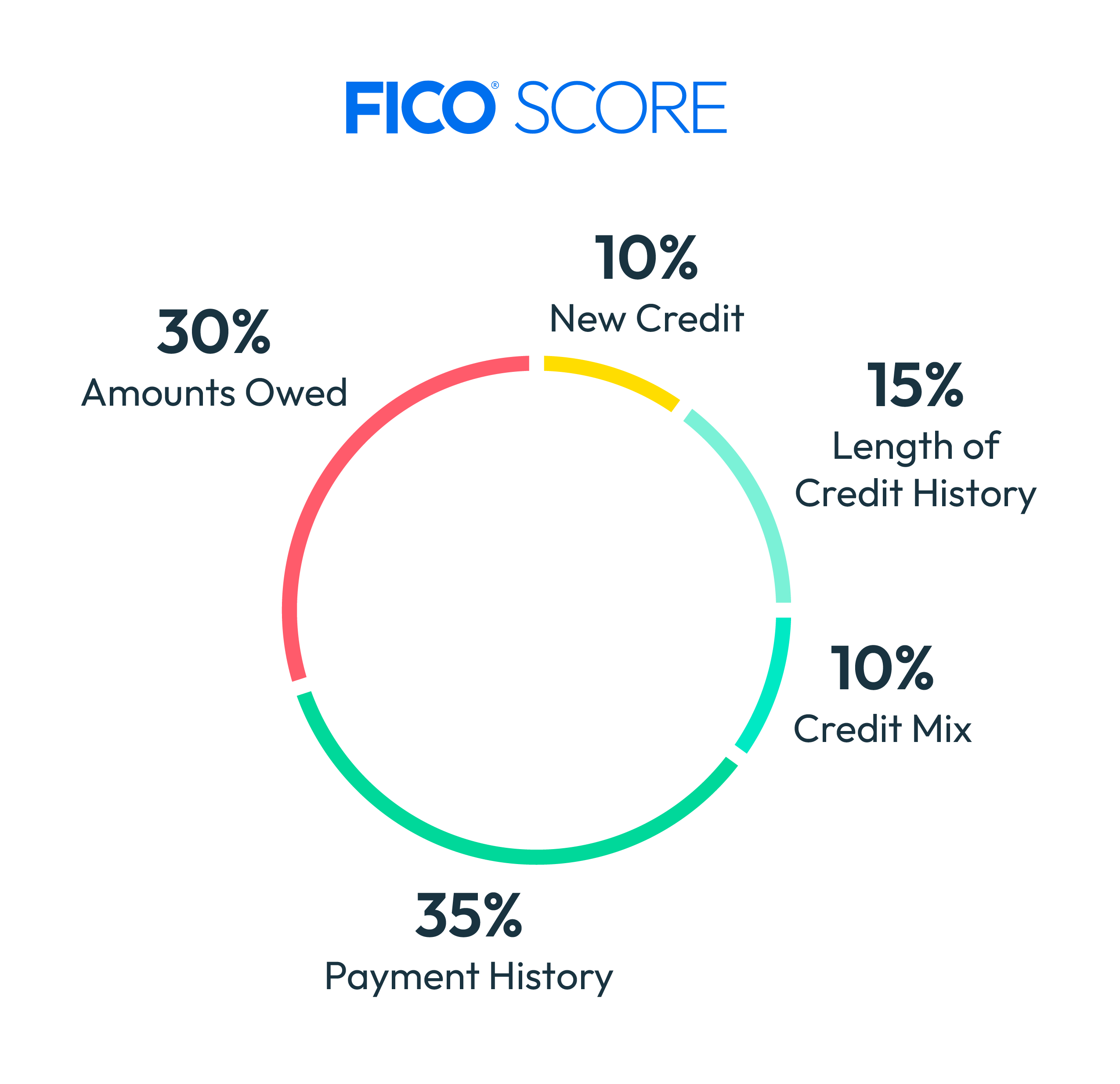

4. myFICO

Key Features

-

Comprehensive FICO® Score insights

-

3-bureau monitoring

-

Score simulators

-

Credit and identity alerts

Why It Stands Out

myFICO is the best choice for consumers who want deep insights into their credit score, especially those preparing for a major financial decision such as buying a home or car.

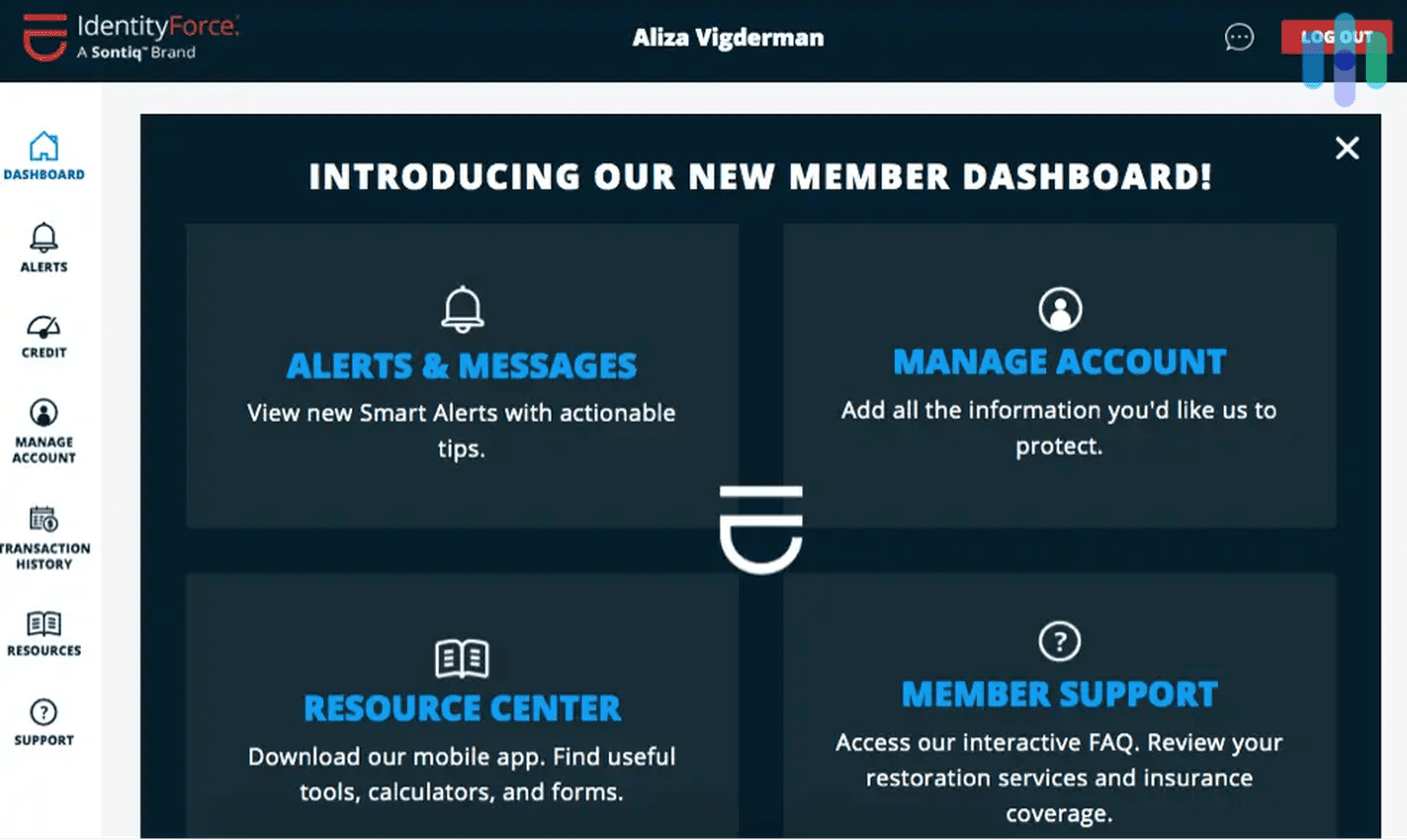

5. IdentityForce

Key Features

-

Real-time credit monitoring

-

Dark web & social media monitoring

-

$1 million identity theft insurance

-

Family protection plans

Who Should Use It

IdentityForce is excellent for families and individuals who need comprehensive monitoring across multiple areas of their digital life.

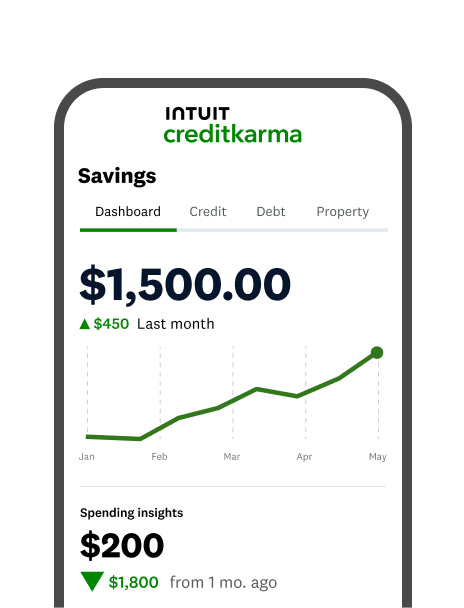

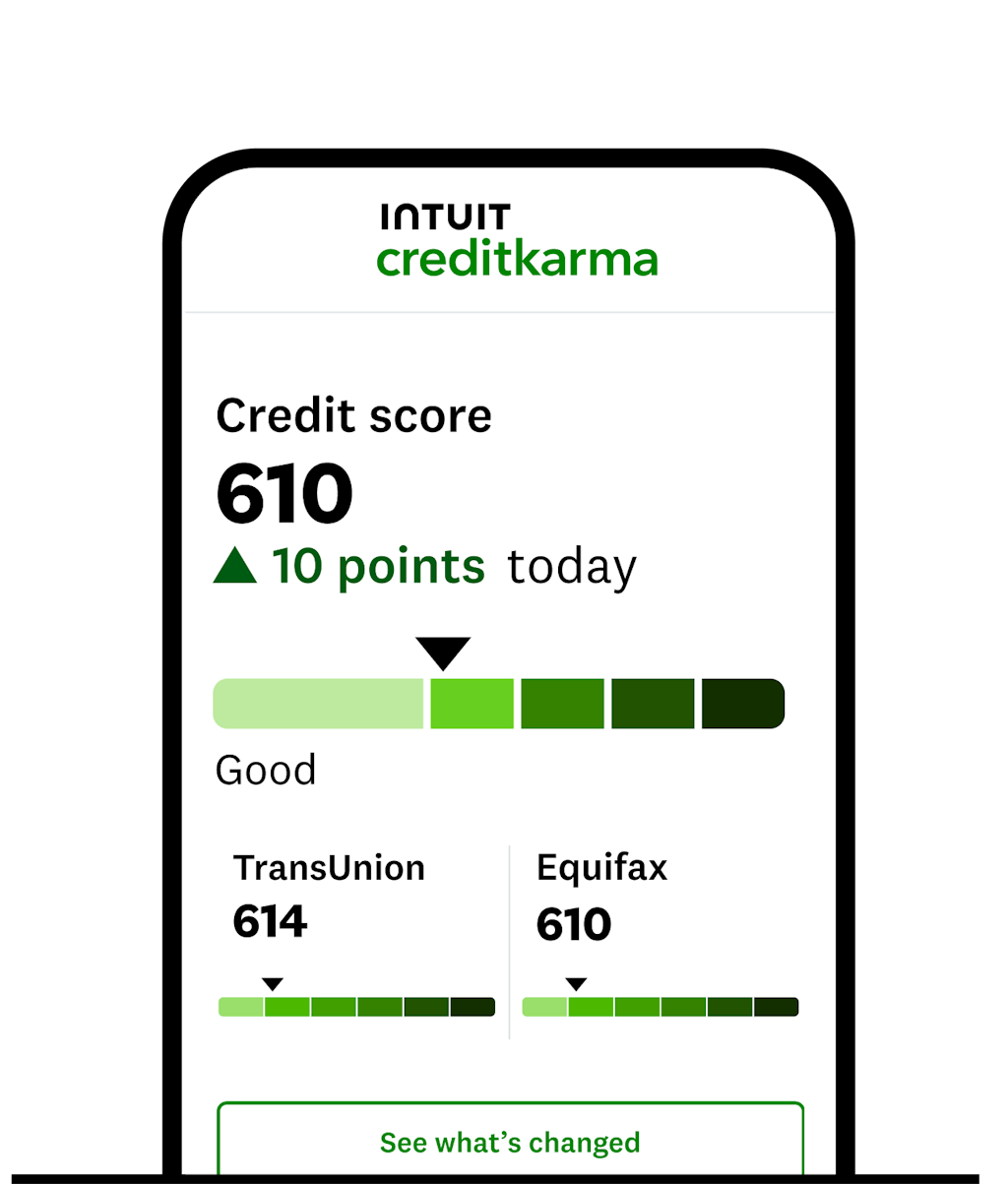

6. Credit Karma (Free Option)

Key Features

-

Completely free monitoring

-

Weekly credit score updates

-

Personalized financial recommendations

-

Tools for loans, credit cards & taxes

Why It’s Great

Credit Karma is the top free credit monitoring service. It delivers reliable credit alerts without subscription fees, making it perfect for beginners and budget-conscious users.

Comparison Table: Best Credit Monitoring Services 2025

| Service | Price | Credit Bureaus | Identity Theft Insurance | Best For |

|---|---|---|---|---|

| LifeLock | Paid | 3 | Up to $1M | Comprehensive protection |

| Experian CreditWorks | Paid | Experian | Up to $1M | Daily updates & FICO scores |

| IdentityGuard | Paid | 3 | Up to $1M | AI-powered security |

| myFICO | Paid | 3 | Up to $1M | Credit score accuracy |

| IdentityForce | Paid | 3 | Up to $1M | Families & professionals |

| Credit Karma | Free | TransUnion, Equifax | None | Budget-friendly monitoring |

How to Choose the Right Credit Monitoring Service

When comparing the list of credit monitoring services, consider the following:

✔ Level of security

Do you need basic monitoring or full identity theft protection?

✔ Frequency of credit updates

Daily, weekly, or monthly—choose based on how closely you want to track changes.

✔ Available insurance coverage

Higher insurance means more protection in case of fraud.

✔ Extra tools

Score boosters, simulators, alerts, and dark web monitoring can add value.

Conclusion

Choosing the right credit monitoring service is essential for keeping your financial identity secure. Whether you prefer a free option like Credit Karma or a premium service like LifeLock or myFICO, there’s a solution tailored to your needs.

This list of credit monitoring services gives you a clear overview so you can make an informed choice—and keep your credit protected throughout 2025 and beyond.